Equity in Family Business Succession Planning in their structure, often combining professional expertise with personal relationships, values, and long-standing traditions. However, one of the most challenging aspects of family businesses is ensuring a smooth and effective succession plan. The transfer of leadership and ownership between generations requires careful consideration to maintain not only the company’s viability but also the relationships that sustain it.

Equity, as both a financial and emotional concept, plays a crucial role in family business succession planning. It involves determining the fair distribution of ownership and control among family members while maintaining the business’s long-term stability and growth. This article delves into the importance of equity in family business succession planning, how to navigate the complex dynamics of ownership transfer, and strategies for ensuring a fair and successful transition.

1. The Importance of Family Business Succession Planning

Succession planning is an essential process for any family business, ensuring that the business can continue to thrive beyond the current generation. Without a clear succession plan, family businesses face the risk of mismanagement, conflicts, and even business failure. The main objectives of family business succession planning are:

- Ensuring continuity: A well-executed plan allows the business to remain operational during and after the transition of leadership.

- Preserving family harmony: Succession can often bring out personal conflicts. A clear plan helps manage familial expectations and relationships.

- Protecting the business’s legacy: A successful transition preserves the company’s core values, reputation, and competitive edge.

Succession planning involves decisions regarding the leadership transition, asset distribution, governance structure, and the allocation of equity. The equitable distribution of ownership is one of the most sensitive and complex aspects of this process, as it can influence both the financial health of the business and the relationships among family members.

2. Understanding Equity in Family Business Context

Equity in the context of a family business refers to the ownership of shares or stakes in the business. Equity represents both financial value and a sense of power or control. In a family business, equity distribution can take various forms:

-

Ownership stakes: This is the most direct form of equity and refers to the percentage of the business that each family member owns. Ownership stakes determine control, decision-making power, and, often, the share of profits.

-

Voting rights: Some family businesses separate ownership from voting rights, giving certain family members the ability to influence decisions without owning the majority of the business.

-

Non-financial equity: In some family businesses, equity may also be tied to non-financial factors, such as the amount of effort, leadership, or involvement a family member has had in building the business over time.

Equity distribution is a critical issue in family business succession planning, as it determines who holds control over the business, who benefits from its profits, and how conflicts may arise among family members. Balancing fairness with the interests of the business is key to ensuring that the succession is successful and sustainable.

3. Challenges of Equity Distribution in Family Businesses

When it comes to succession planning, distributing equity among family members can be a complicated process fraught with potential challenges. Several factors complicate the equity distribution process:

3.1 Balancing Fairness and Equality

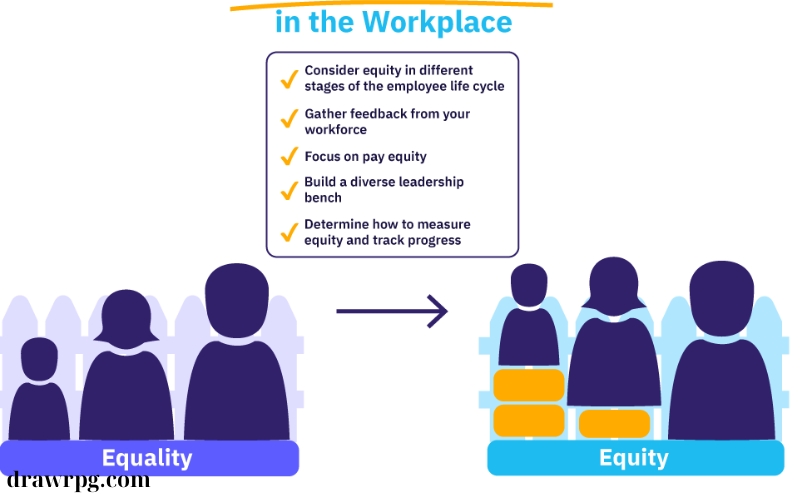

A common misconception is that equity distribution in family businesses should be equal, meaning each family member receives an identical share. However, equality is not always the best approach for the business’s long-term health. It’s crucial to consider factors like each family member’s contribution to the business, both financially and in terms of time, expertise, and leadership.

-

Merit-based distribution: Equity could be distributed based on the individual’s contributions to the business. For instance, a family member who has been actively involved in growing the business might deserve a larger stake.

-

Role-based distribution: If some family members will continue managing the business while others take more of a passive role, the equity split might reflect this difference in responsibility.

3.2 Avoiding Family Conflict

Family dynamics often complicate equity distribution. Disagreements about who should own what portion of the business can lead to family conflict, especially if the distribution is perceived as unfair. It is essential to establish a transparent process for equity allocation that all family members can agree upon, to avoid long-term resentment or dysfunction.

-

Open communication: Involving all relevant family members in the planning process and being transparent about the business’s needs can help prevent misunderstandings and ensure that the process is understood and accepted by everyone involved.

-

Mediation and conflict resolution: Sometimes, having an impartial mediator or family business advisor can help resolve disputes over equity distribution and other succession issues.

3.3 Protecting the Business’s Legacy

The primary goal of family business succession planning should be the preservation of the business’s success. This means that equity distribution must not only reflect fairness but also maintain the business’s integrity and future prospects.

-

Succession of management: Sometimes, the person best suited to lead the business may not be the same person who is next in line to inherit it.

4. Strategies for Effective Equity Distribution in Succession Planning

These strategies aim to balance family dynamics, business continuity, and the fair treatment of all stakeholders.

5. The Role of Professional Advisors in Equity Distribution

Given the complexity of family dynamics, business objectives, and legal considerations, family businesses often turn to professional advisors to guide them through the equity distribution process. These advisors might include: