Corporate Governance and Equity, effective corporate governance is paramount to ensuring that companies operate in a responsible, ethical, and transparent manner. Corporate governance encompasses the systems, principles, and processes by which companies are directed and controlled. It plays a crucial role in balancing the interests of various stakeholders, including shareholders, employees, customers, suppliers, and the broader community. One of the central aspects of corporate governance is equity—how ownership, control, and financial returns are distributed among stakeholders.

Equity, in the corporate governance context, does not solely refer to financial ownership but also includes fairness, representation, and the broader distribution of resources. Ensuring equity is fundamental to maintaining trust, promoting long-term success, and fostering a positive organizational culture. This article will explore the relationship between corporate governance and equity, with a focus on balancing stakeholder interests, the challenges companies face, and the strategies to achieve effective governance.

1. Understanding Corporate Governance and Stakeholder Interests

Before diving into the intricate relationship between corporate governance and equity, it’s essential to first understand what corporate governance entails and who the key stakeholders are.

1.1 The Role of Corporate Governance

Corporate governance refers to the structures, policies, and practices that ensure a company is run in a way that meets the expectations of stakeholders. It includes mechanisms that control the decision-making process, oversight, and accountability of the organization. Corporate governance covers aspects like:

- Board composition: The structure, roles, and responsibilities of the board of directors.

- Executive leadership: The roles and duties of executive management in implementing the board’s decisions.

- Risk management and internal controls: The mechanisms in place to identify and manage business risks effectively.

- Transparency and accountability: Ensuring that the company operates in an open and honest manner, particularly in financial reporting and decision-making.

1.2 The Stakeholders of a Corporation

A corporation has a diverse set of stakeholders whose interests may sometimes align but often conflict. These stakeholders include:

- Shareholders/Investors: Primarily interested in the financial returns on their investment. Their interests are typically focused on maximizing shareholder value, including dividends and capital appreciation.

- Employees: Concerned with job security, fair wages, benefits, and career development opportunities. Employees’ interests also include company stability and a supportive work environment.

- Customers: Seek high-quality products and services at competitive prices, along with good customer service and ethical business practices.

- Suppliers: Interested in reliable contracts, fair payment terms, and a consistent business relationship with the company.

- The Community: Local communities and broader society are stakeholders concerned with the company’s social responsibility, environmental impact, and ethical business practices.

- Regulators: Government entities that enforce laws and regulations to ensure that the company operates within legal frameworks.

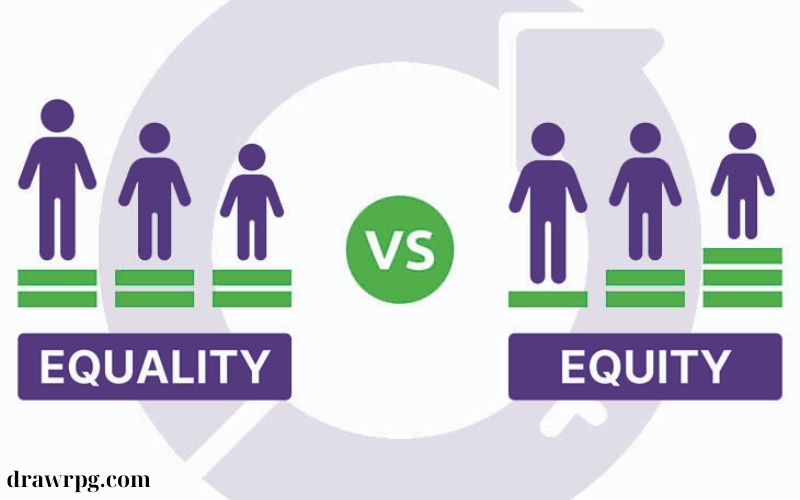

2. Equity in Corporate Governance: Not Just Financial Ownership

Equity is often associated with financial ownership in a company. However, in the context of corporate governance, equity goes beyond just shareholders and financial stakeholders. It also refers to fairness, justice, and the representation of different stakeholder interests in decision-making processes.

2.1 Ownership and Control

At the most basic level, equity in a corporation refers to the ownership stake that shareholders hold in the company. Shareholders exercise their control over the company through voting rights at general meetings, where major decisions are made. The distribution of equity, therefore, plays a critical role in determining who holds power and decision-making authority within the organization.

In many companies, a small number of shareholders (often the founders or large institutional investors) hold a significant percentage of equity, which can give them substantial control over corporate decisions. This creates a potential imbalance of power, where the interests of minority shareholders and other stakeholders might be overlooked.

2.2 Fairness and Representation in Decision-Making

Equity in governance also refers to ensuring that all stakeholders, not just shareholders, have a fair opportunity to be represented in the decision-making processes of the company. Employees, customers, and other non-financial stakeholders may not have direct ownership but still play a critical role in the long-term success of the organization.

-

Employee equity: Many companies offer stock options or employee shareholding schemes to align employee interests with company success. These initiatives aim to give employees a sense of ownership, responsibility, and commitment to the business.

-

Diversity and inclusion in governance: Effective corporate governance also involves creating a diverse board and leadership team that represents a range of perspectives, which helps ensure equity in decision-making processes. Gender, racial, and cultural diversity on boards are increasingly recognized as essential to fostering better governance practices and long-term success.

2.3 Ensuring Accountability

Equity in corporate governance also encompasses transparency and accountability in decision-making. A governance structure that ensures that all actions and decisions made by leadership are aligned with the interests of various stakeholders promotes equity.

Accountability in corporate governance means that the board and management are responsible for making decisions that consider the well-being of not just shareholders but also employees, customers, suppliers, and the environment. The company must disclose relevant information, including financial performance, risk exposure, and corporate social responsibility initiatives, to its stakeholders.

3. The Challenge of Balancing Stakeholder Interests

One of the primary challenges of corporate governance is finding a balance between the often competing interests of different stakeholders. Shareholders typically focus on maximizing their return on investment, while employees may prioritize job security and fair treatment. Customers and the community might demand ethical practices, sustainability, and social responsibility, which could come at a cost.

3.1 Shareholder vs. Stakeholder Capitalism

In recent years, the debate between shareholder capitalism and stakeholder capitalism has become a central issue in corporate governance. Shareholder capitalism focuses on maximizing profits for shareholders, often prioritizing financial performance over other concerns. In contrast, stakeholder capitalism seeks to balance the needs of all stakeholders, recognizing that long-term value creation depends on considering the interests of employees, customers, suppliers, and the community.

Balancing these competing interests requires a nuanced approach:

-

Maximizing shareholder value: This is a primary objective for most corporations, especially publicly traded companies. However, short-term profit maximization can sometimes come at the expense of long-term sustainability, employee well-being, or environmental considerations.

-

Long-term stakeholder value: Corporations that adopt a stakeholder model recognize that maintaining a stable workforce, customer loyalty, and strong supplier relationships are crucial to long-term success. By focusing on broader stakeholder interests, companies aim to build sustainable business practices that will endure beyond short-term financial results.

3.2 Addressing Conflicts of Interest

Conflicts of interest are common in corporate governance, especially when one group of stakeholders—such as major shareholders—pushes for decisions that might benefit them in the short term, but harm other stakeholders, such as employees or the environment, in the long term.

For example, a company might choose to reduce costs by outsourcing jobs to lower-wage countries, which could maximize short-term profits and satisfy shareholders. However, this decision could harm employee interests and damage the company’s reputation among customers who value ethical practices. Balancing such conflicting interests requires strong leadership, transparent decision-making processes, and a focus on long-term sustainability.

4. Strategies for Balancing Stakeholder Interests in Corporate Governance

Achieving a balance between equity and stakeholder interests requires intentional strategies and a commitment to fair governance practices. Some key strategies include:

4.1 Implementing Corporate Social Responsibility (CSR) Initiatives

Corporate social responsibility (CSR) plays a crucial role in aligning the interests of shareholders with those of other stakeholders. CSR initiatives focus on environmental sustainability, ethical labor practices, and community engagement, helping companies to build goodwill with customers and employees while maintaining profitability.

-

Sustainable business practices: Investing in renewable energy, reducing carbon footprints, and ethical sourcing are examples of how companies can balance shareholder returns with broader societal goals.

-

Engaging with stakeholders: Regular communication with customers, employees, and the community can help corporations understand their needs and concerns, fostering a sense of shared responsibility and mutual benefit.

4.2 Strengthening Governance Structures

Robust governance structures are essential to balancing stakeholder interests. This involves creating a clear framework for decision-making, ensuring that all stakeholders are represented, and holding leadership accountable.

-

Independent boards: Having independent directors on the board helps reduce conflicts of interest and ensures that decisions are made in the best interest of all stakeholders, not just major shareholders.

-

Stakeholder representation: Some companies are exploring models that include employee representatives or customer advisory boards to ensure that the interests of non-shareholder stakeholders are taken into account in decision-making.

4.3 Long-Term Strategic Vision

Adopting a long-term strategic vision can help reconcile short-term financial goals with long-term stakeholder interests. Companies must be willing to invest in sustainable growth, even if it means sacrificing immediate returns.

-

Investing in people: A company’s employees are among its most important assets. Investing in training, career development, and fair wages fosters loyalty and promotes a productive workforce, which benefits the company in the long run.

-

Customer loyalty: Building a brand that is trusted and respected by customers can lead to long-term profitability. Companies that prioritize customer satisfaction and quality over short-term cost-cutting are more likely to build enduring relationships with their customer base.